Points Program

Symbiotic Points reward participants that provide useful economic security through the protocol. They are earned by depositing collateral into vaults and, in Season 2, by delegating that collateral to secure networks.

You can view your points by connecting your wallet at https://app.symbiotic.fi. If you participate through wrappers such as LRTs, some or all of your points may be shown in the provider’s own interface instead of the Symbiotic app.

Participation in the Points Program is subject to Symbiotic’s Terms of Use, Points Program Terms, and Risk Factor Disclosure Statement.

Seasons

Season 1: Pre-Deposit phase

Season 1 covers the initial rollout of Symbiotic from June 2024 until the deployment of feature complete core contracts on Ethereum mainnet.

During this phase, Pre-Deposit (default collateral) vaults were deployed for assets such as wstETH, mETH, wBTC and others. These vaults did not yet delegate stake to networks. Depositors earned points based mainly on the size and duration of their collateral. Over this period, Pre-Deposit vaults accumulated roughly 2B USD of TVL.

Season 2: Actively delegated stake

Season 2 starts with the mainnet deployment of core contracts. From this point, vaults can be deployed that delegate collateral to operators on Symbiotic networks.

Season 2 is designed as a transition from idle collateral into fully deployed security. The key changes are:

- Delegated collateral earns a higher points rate than idle collateral in Pre-Deposit vaults

- Points for Pre-Deposit vaults continue at a lower rate and are intended to phase out over time

- Depositors are encouraged to move into actively delegated vaults curated by LRTs, operators, institutions and network foundations

If you use Symbiotic via an LRT, your provider may manage this migration on your behalf. If you deposit directly, the Symbiotic app guides you through moving from Pre-Deposit vaults to actively delegated vaults.

Who Earns Points

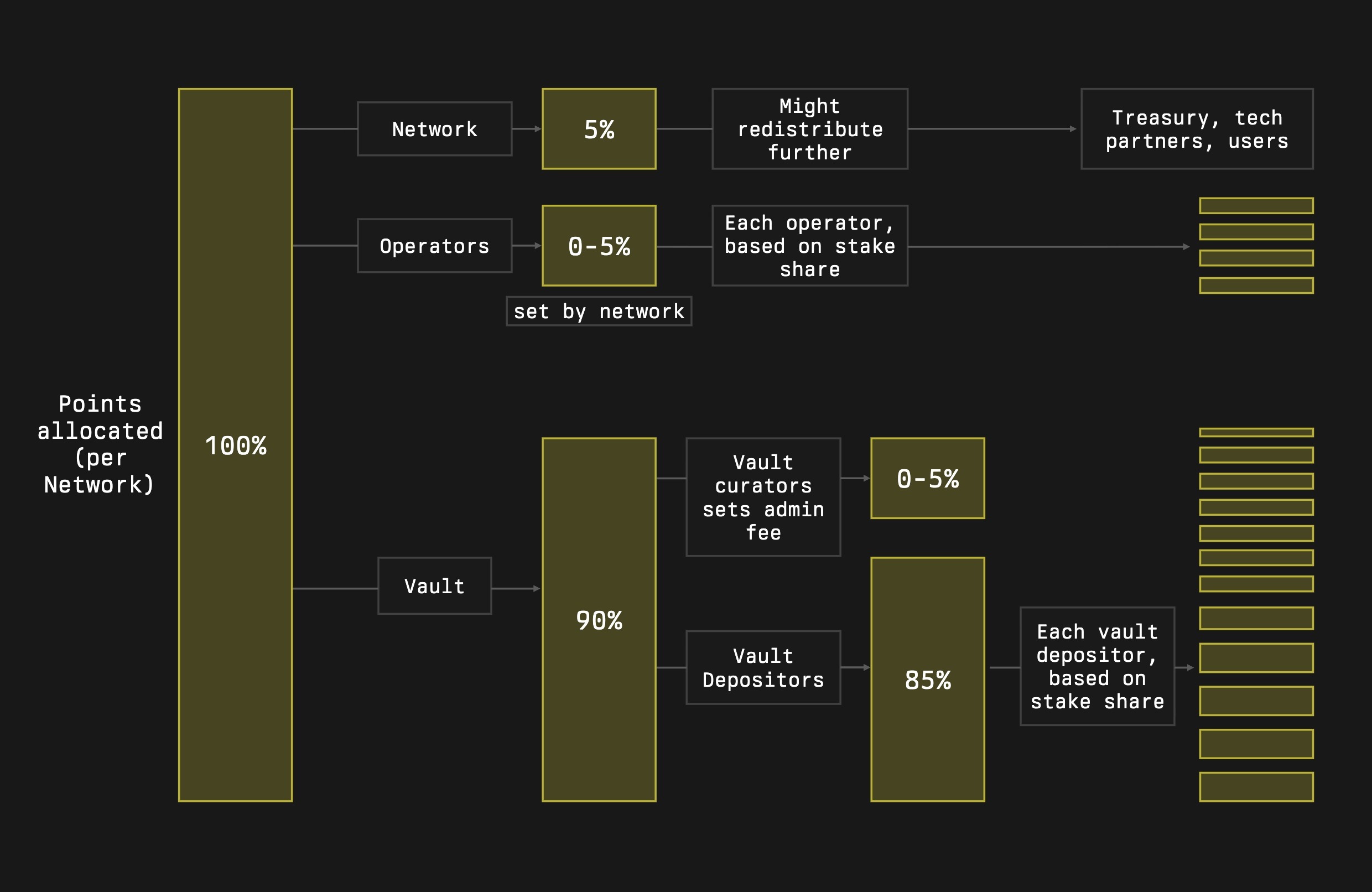

Points are assigned on a per-network basis and then split across three groups:

- The network itself

- Operators on that network

- Vaults that delegate stake to the network and their depositors

Networks can receive up to 5% of total allocated points, while allocating another up to 5% to operators. The remaining points go to vaults, where curators can charge an additional admin fee of up to 5%, with the rest distributed to depositors pro rata to their share of the vault’s TVL.

This ensures that all contributors to shared security are rewarded, while the strongest incentives remain aligned with staked capital.

How Points Are Calculated in Season 2 and Points 2.1

Points 2.1 refines Season 2 by tying rewards more tightly to how capital is actually deployed and how safely it is used.

At a high level, each network receives:

Points per hour = NetworkStake × PointsRate × 0.001

PointsRate = MiningRate × SecurityRate

Everything is computed per network, then split to networks, operators, and vaults as described above.

Mining Rate: stake relative to target

Each network has a target stake, in USD terms. This is the amount of collateral that is considered appropriate for its security needs.

- When a network is below its target stake, the mining rate is high and each extra unit of stake earns close to the maximum number of points

- As the network approaches and exceeds its target, the mining rate is reduced so additional stake earns fewer or no extra points

This discourages over-staking on a single network purely for points and helps push capital toward networks that still need security.

Security Rate: how stake is used and distributed

The security rate measures how risk aware a network’s stake is. It combines two ideas:

- Restaking score of the underlying vaults

- How decentralised stake is across those vaults

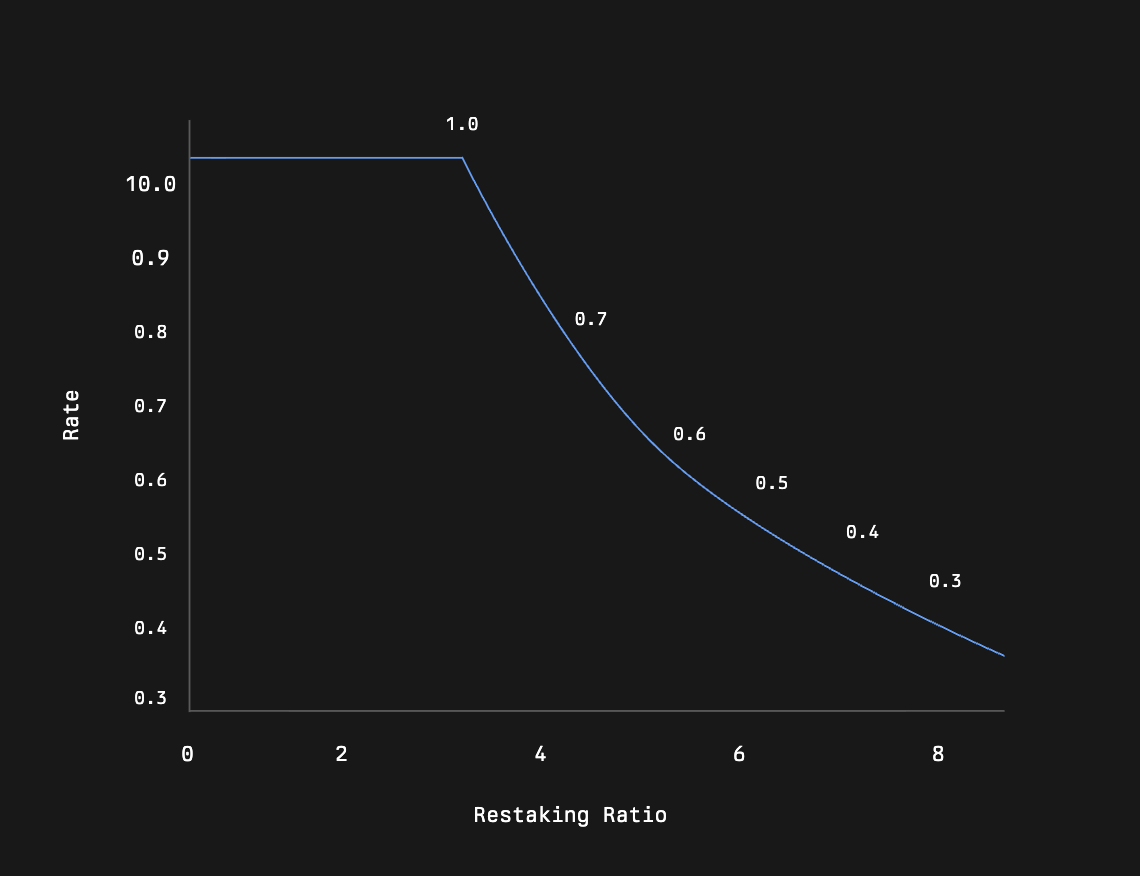

Restaking score

Restaking is measured as the ratio between:

Restaking ratio = Total delegated stake of the vault / Vault TVL

A higher ratio means the same collateral is used to secure more networks. This can be capital efficient, but also increases potential correlated slashing risk.

Points 2.1 uses a target restaking ratio (currently 3). Around this ratio, the restaking score is high. When a vault’s ratio climbs significantly above this, its restaking score falls quickly. This affects both:

- The network’s security rate if it relies heavily on that vault

- The vault’s own share of points from the network, since vault rewards are multiplied by their restaking score

Stake decentralisation across vaults

To avoid having one vault dominate a network’s security, Points 2.1 uses a decentralisation score derived from the complement of the Herfindahl–Hirschman Index. It ranges from 0 (all stake effectively in a single vault) to 1 (stake spread across many vaults).

The security rate is a stake-weighted combination of restaking scores and this decentralisation score. Networks that rely on sane restaking and multiple vaults earn a higher security rate and therefore more points for the same amount of stake.

Vault Behaviour and Delegation

From the perspective of a depositor, the main rules are simple:

- Points are only accrued on collateral that is actively delegated from a vault to networks

- The effective points per unit of collateral depend on how much of the vault’s TVL is delegated, how many networks it supports, and how aggressive its restaking ratio is

This implies:

- A well-utilised delegated vault will generally earn more points than a Pre-Deposit vault

- A vault that barely delegates, or that is very concentrated on a single network, may earn fewer points than a better balanced alternative

- A vault that pushes its restaking ratio far above the target can see its points reduced, even if it holds a large TVL

The Symbiotic app shows vault-level information such as TVL, delegated stake, and expected points, to help depositors choose where to allocate collateral.

Pre-Deposit Vaults and Migration

Season 1 Pre-Deposit vaults remain part of the system in Season 2, but with reduced incentives. They continue to earn points at a lower rate for a transition period. Over time, rewards are intended to shift more fully toward vaults that actively delegate stake to networks.

A typical migration path for a direct depositor is:

- Withdraw or migrate from a Pre-Deposit vault

- Deposit into an Actively Delegated vault

- The curator allocates stake from that vault across one or more networks

- Points accrue based on delegated stake and each network’s points rate under Points 2.1

Wrappers and LRTs may perform equivalent steps internally for their users.

Tracking Your Points

You can track your points directly in the Symbiotic app by connecting your wallet.

For a more detailed view under Points 2.1, including how your capital is distributed across networks and vaults and how that affects your effective points rate, you can also use the Symbiotic Points dashboards on Dune.