Vaults

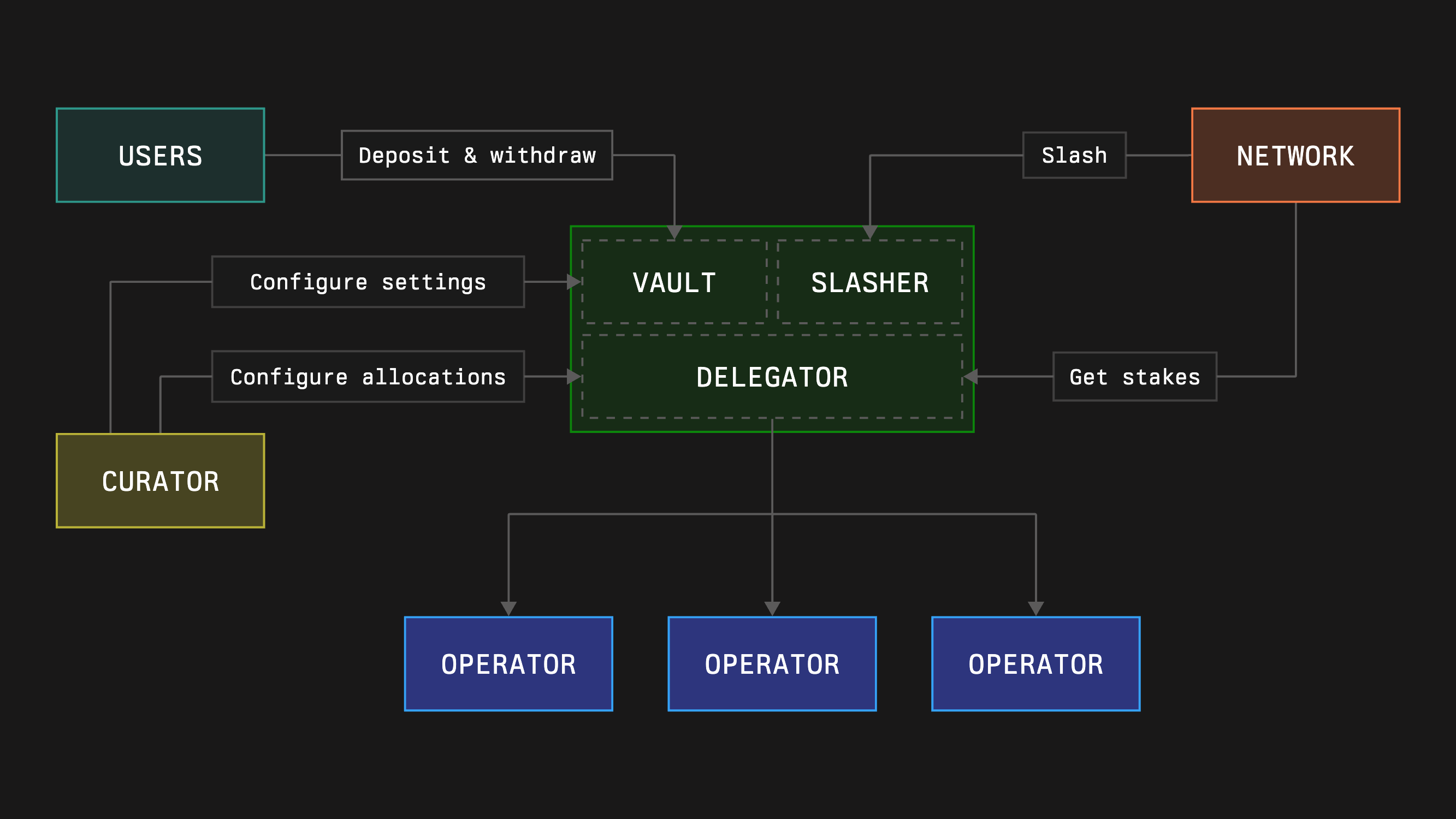

A vault is the on chain container that holds collateral and connects it to networks. Each vault holds a single collateral token, keeps track of who has deposited and who can withdraw, and exposes the configuration points that let curators define how delegation, slashing, and rewards work. Delegation itself is purely an accounting layer: collateral stays inside the vault and only leaves when users withdraw or when a valid slashing event is executed.

Core modules

Every Symbiotic vault is built from a small set of modules:

- Accounting (Vault): deposits, withdrawals, epochs, and penalties

- Delegation (Delegator): stake per network and per operator, based on curator policy

- Slashing (Slasher): checks and applies penalties requested by networks

Accounting

Deposits

Any address that passes the vault access policy can deposit the collateral token. By depositing, a staker opts into that vault’s strategy and risk profile.

The vault:

- records the deposit

- updates the user balance and total active stake

- keeps collateral in the vault contract

Each vault uses a single collateral token. Multi asset exposure is achieved by using multiple vaults.

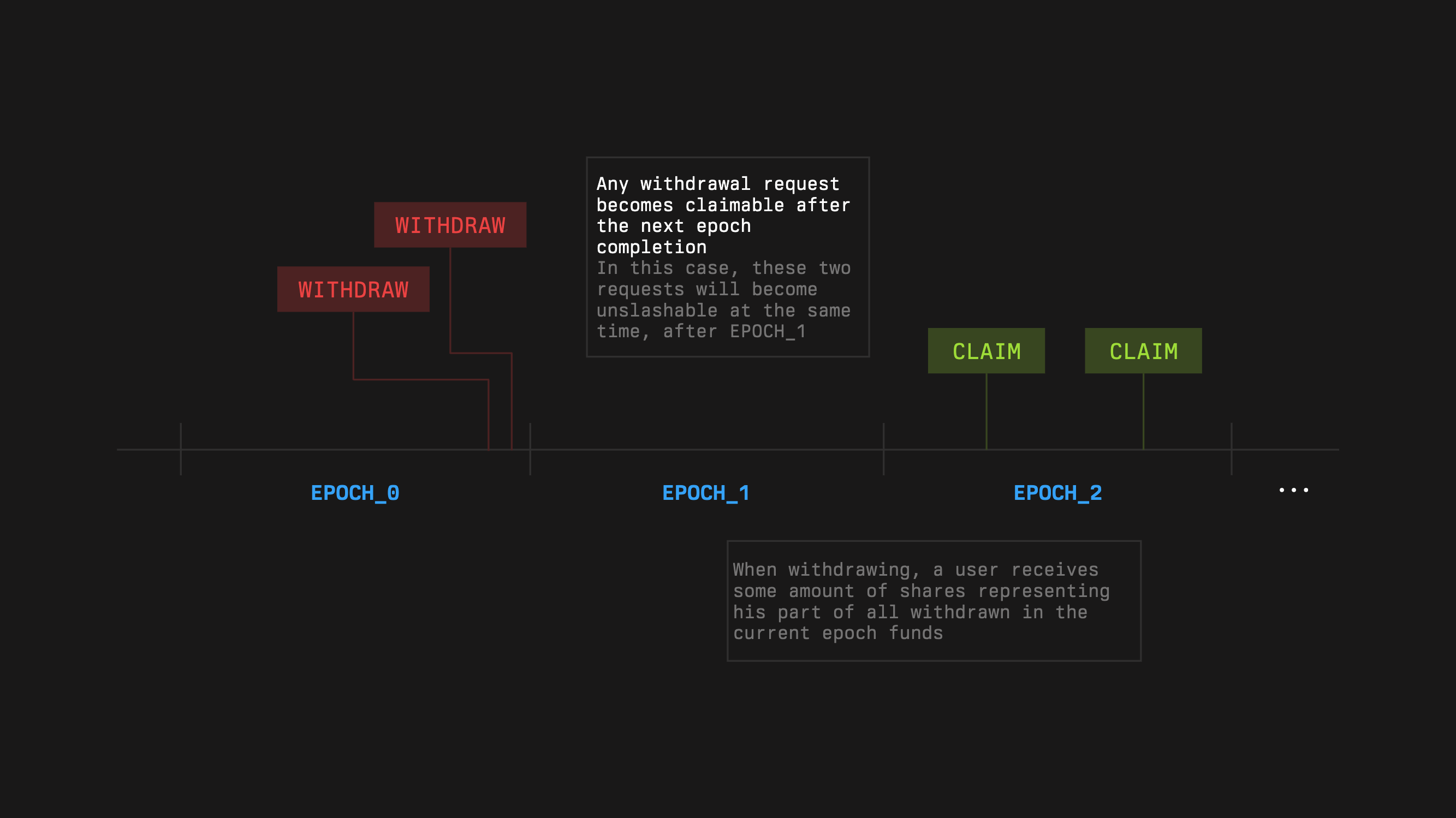

Withdrawals and epochs

Withdrawals use an epoch based flow. The goal is to let users exit while keeping operator stake stable inside each epoch.

At a high level:

- A user submits a withdrawal request at any time.

- The request becomes claimable after the end of the next vault epoch.

- Until that epoch boundary, the requested amount is still eligible for slashing.

Epoch length is chosen at deployment and stays constant. Longer epochs give more time for networks to report misbehavior but make withdrawals slower. Shorter epochs make exits faster but leave less room for disputes.

Delegation

Delegation is how a vault’s stake becomes effective security for networks and operators.

Curators:

- choose which networks the vault supports

- set limits or target shares per network and per operator

- select a Delegator type that matches the vault thesis

The Delegator looks at the vault active balance, which operators and networks opted into this vault, and the configured limits or shares. From this it returns how much stake a given operator has for a given network at a point in time.

Different Delegator types cover patterns like:

- one operator across many networks

- many operators inside one network

- multiple networks and multiple operators in a single portfolio

The vault holds collateral in one place. The Delegator decides how that collateral is counted as stake across Symbiotic.

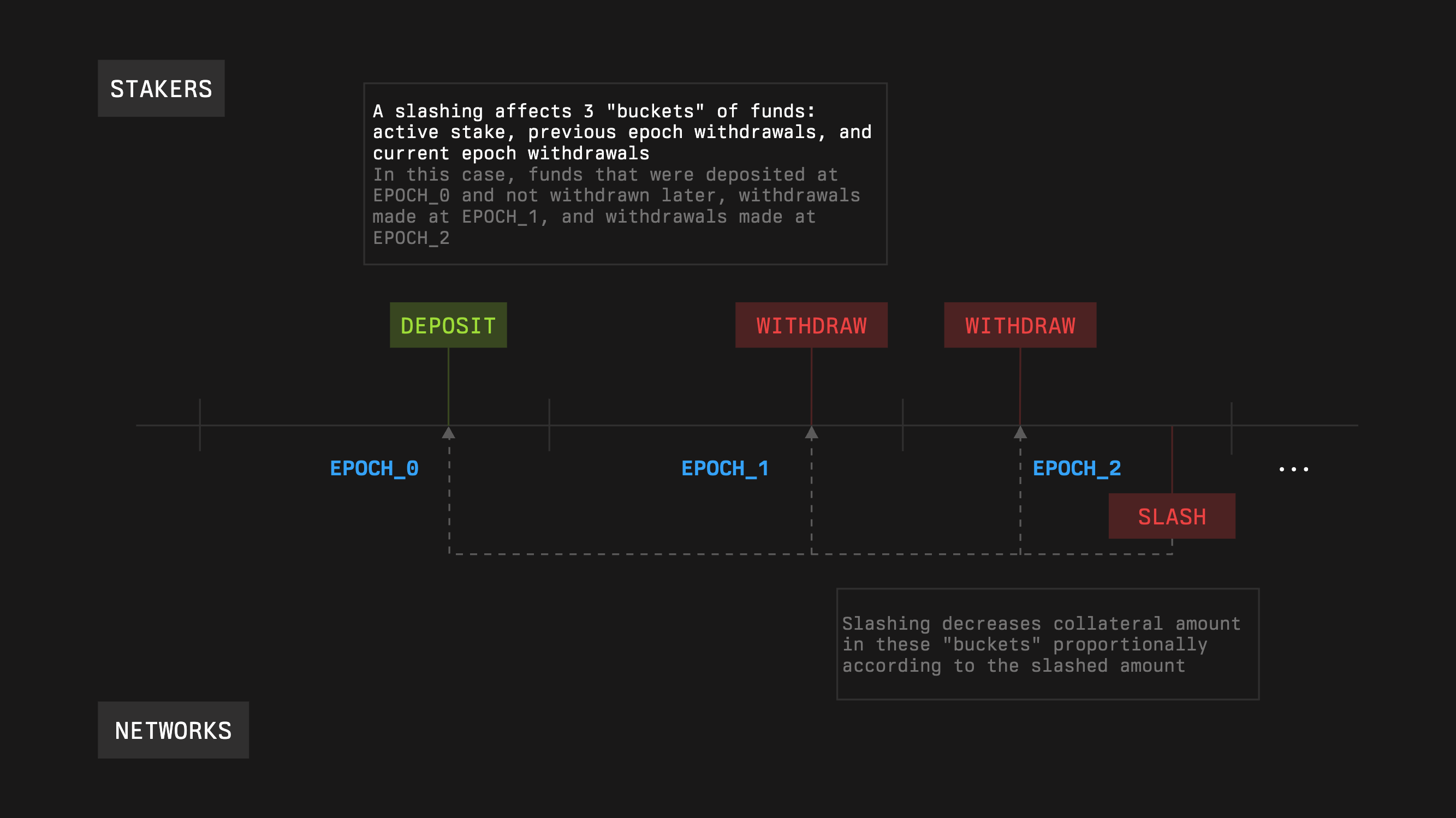

Slashing

When an operator breaks the rules, part of the vault collateral can be penalized.

Networks do not slash directly. They send a slashing request to the Slasher module that includes which network or subnetwork is affected, which operator is at fault, how much to penalize, and which snapshot this refers to.

The Slasher:

- Checks that the request is fresh enough and consistent with the vault guarantees.

- Verifies that there is enough stake tied to that snapshot to cover the penalty.

- If valid, applies the penalty to vault balances and calls the configured Burner to decide where penalized collateral goes, for example a burn, redistribution to users, a treasury, or an insurance pool.

Some configurations apply valid slashes immediately. Others introduce a short review window where a resolver can veto or challenge.

Rewards

Vaults do not hard code rewards. They only provide stake that secures networks and operators.

Each network decides:

- how stakers and operators are paid

- whether rewards come from fees, external clients, token inflation, or a mix

- which reward contracts or extensions they use

Symbiotic’s rewards framework gives networks standard ways to send value back to stakers, who provide collateral and take slashing risk, and to operators, who run the services the network depends on.

Vault types

Vaults are configurable templates for different strategies and use cases.

Anyone who holds the collateral token can deposit, subject to any global caps the curator defines. These are usually used for broad, permissionless participation.

Private vaultsOnly allowlisted addresses can deposit. LRT and LST providers, funds, or DAOs often run private vaults, aggregate user funds on their own balance sheet, and then allocate across several Symbiotic vaults on behalf of their users.