Curators

Curators set and maintain a vault’s policy. They choose how stake is spread across networks and operators, which slashing flow applies, and who can deposit. Stakers pick a vault because they trust the curator’s discipline on risk and timing. While in single‑operator vaults the operator may act as curator, immutable vaults remove ongoing curator control after deployment.

Responsibilities

A curator turns a staking strategy into on‑chain parameters and keeps the vault aligned as conditions change. They select a Delegator type and apply per‑network and per‑operator limits or shares so allocations match the stated thesis. They choose a Slasher (instant or vetoed) and, for vetoed flows, may appoint a resolver set. They configure the Burner to define outcomes for slashed collateral. At deployment, they also set the vault epoch and access control logic, keeping deposits public or allowlisted.

Curator Types

Curators are the entities responsible for risk management in Symbiotic vaults, so they need a clear view of the inherent risks of each network they underwrite. In practice, curators can take several forms: liquid funds allocating capital across networks and operators, node operators who understand infrastructure and liveness risk first-hand, LRT / LST issuers extending their own risk frameworks into restaking, or specialized risk-management firms that design conservative, policy-driven strategies for third parties.

Tools and Strategy

Together, the Slasher, Epoch and withdrawals, Delegator, and Burner define how the vault takes risk, how fast it can react, and what happens when things go wrong. Getting these right is essential to keeping the vault’s behavior aligned with its stated risk profile.

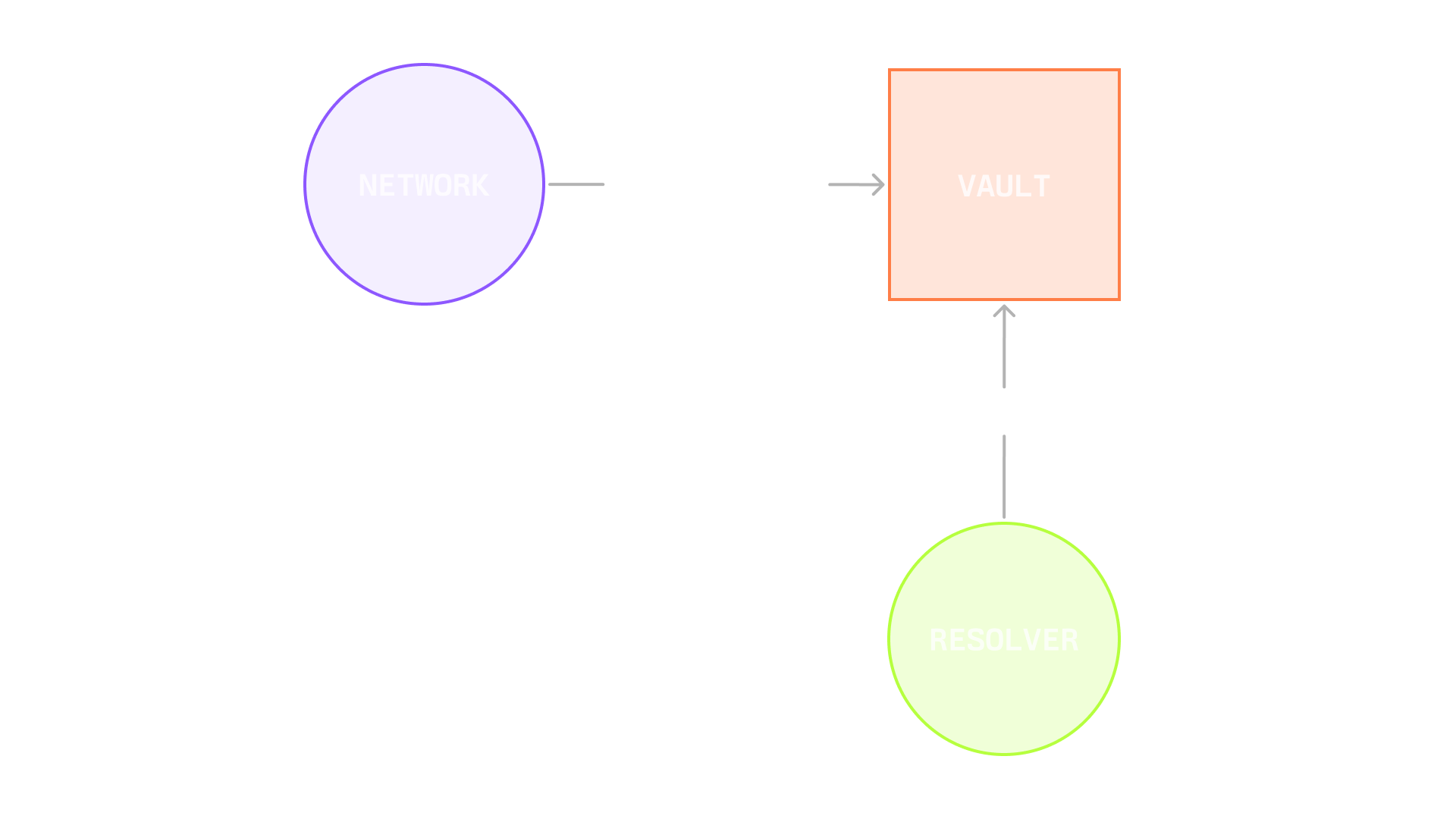

Slasher

The Slasher defines how and when collateral can be penalized when networks report misbehavior.

Curators choose between instant slashing, where penalties are applied as soon as a valid proof is delivered, and vetoed slashing, where a resolver set has a short window to challenge or veto a proposed slash. Instant slashing is cleaner and faster, but less forgiving if monitoring is imperfect. Vetoed flows add an extra layer of human or hybrid review, at the cost of latency and some operational overhead. The slashing mode should match the vault’s risk profile and the curator’s ability to monitor incidents in real time.

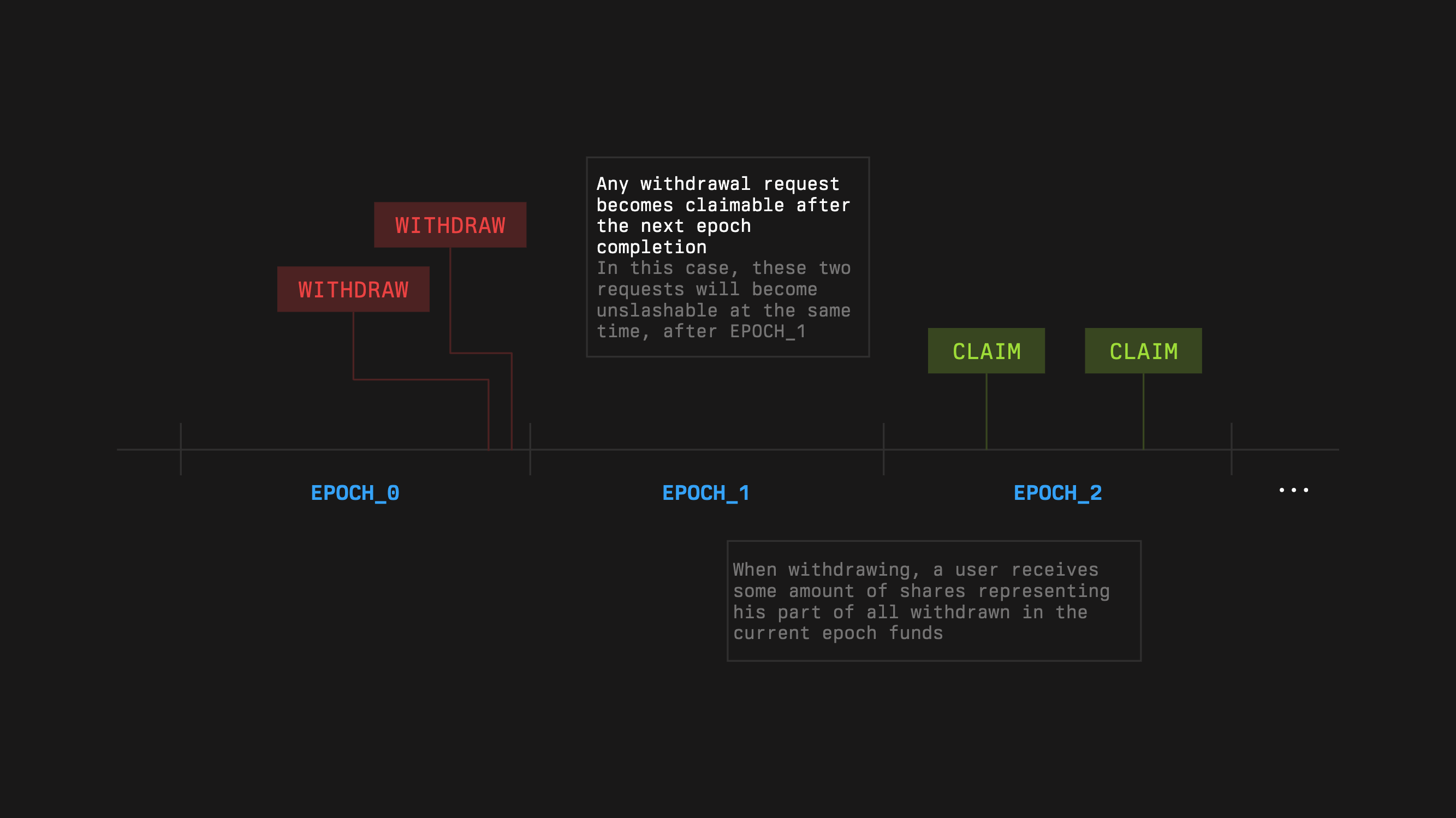

Epochs and Withdrawals

The vault epoch ties together guarantees, slashing timing, and liquidity for stakers. Withdrawals are directly tied to this: how quickly users can fully exit the vault depends on the epoch duration and where they are inside that cycle.

Curators pick an epoch length that comfortably covers the network’s own epoch/finality, any veto window, and the time needed to execute slashes. A longer epoch usually means stronger guarantees (more time to observe and act) but slower reaction for withdrawals and reallocations. A shorter epoch improves responsiveness but leaves less room for disputes. Withdrawal mechanics should be aligned with this: conservative vaults accept slower exit in exchange for robust slashing, while more aggressive ones may prioritize faster liquidity and shorter epochs.

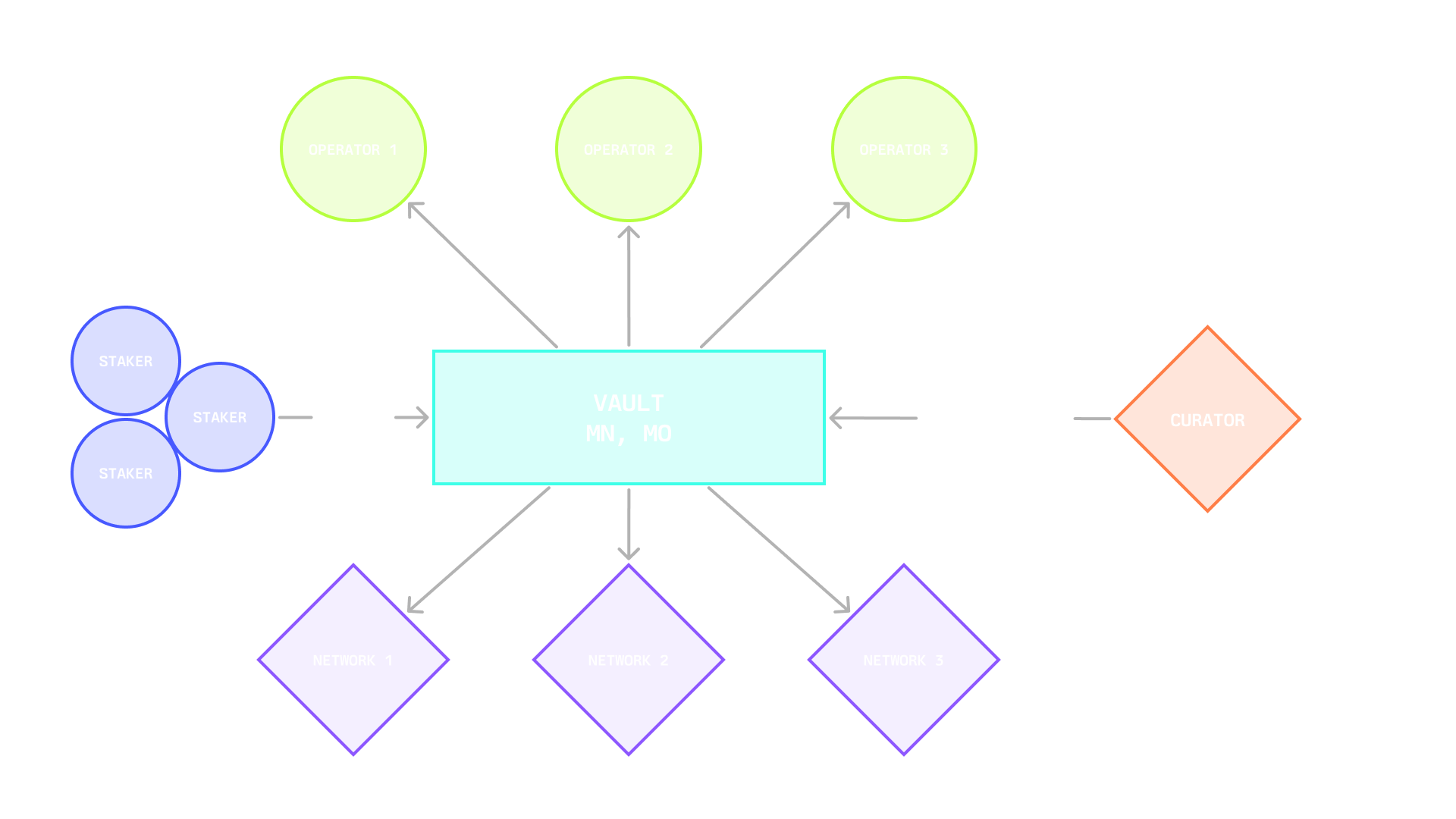

Delegator

The Delegator encodes the allocation strategy and defines how stake is spread across networks and operators.

Curators choose a Delegator type based on the structure of the vault. For a single network and a single operator, the Delegator can simply route all stake to that operator. For a single network with multiple operators, the Delegator can enforce how stake is restaked across those operators, for example by applying ceilings for each one or by targeting specific operator shares. For multiple networks, the Delegator first decides how much stake each network receives, then how that stake is divided among the operators inside each network. These parameters are how curators express diversification rules, concentration limits, and risk budgets for each network and each operator on chain. In practice, most of the portfolio work a curator performs is captured in how they configure and update the Delegator over time.

One example is the “Multiple Networks, Multiple Operators” vault, which, as the name suggests, allows delegations to several operators across different networks, and lets stake be restaked across those networks.

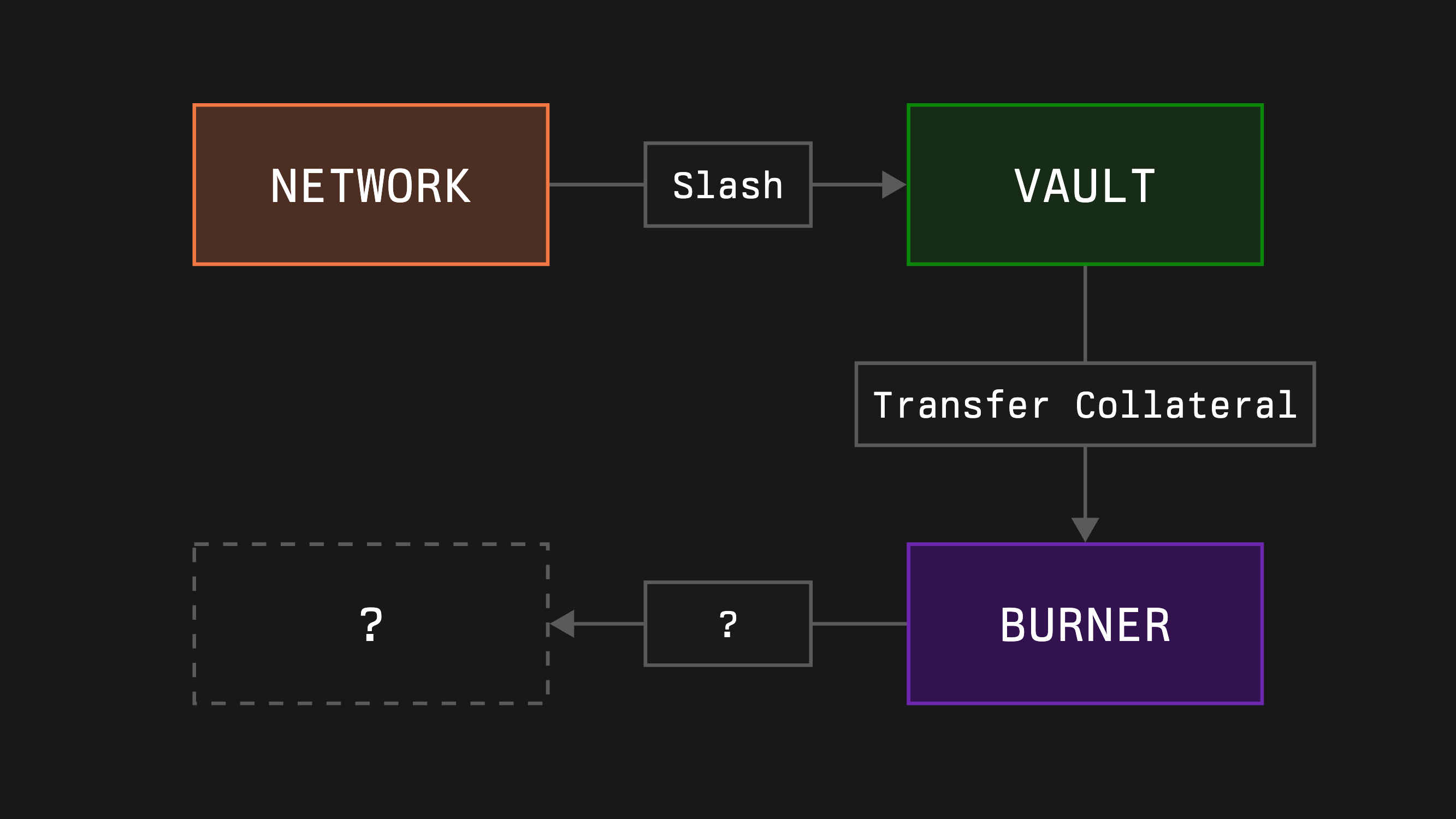

Burner

The Burner decides what happens to slashed collateral once a penalty is applied.

Curators can route slashed funds to different sinks: pure burn (reduce supply), redistribution to remaining stakers, funding an insurance backstop, or sending value back to affected networks. This choice affects incentives: harsh burns are strong deterrents but fully socialize losses, while redirecting part of the slash to an insurance or remediation pool can help absorb shocks more gracefully. The Burner configuration should be consistent with how the vault markets itself: pure risk-taking, conservative insurance-like, or somewhere in between.